Fibonacci calculator stocks

These ratios are found in the Fibonacci sequence. This Fibonacci Calculator allows you to generate basic Fibonacci retracement and extension values in both up and down trends.

/GettyImages-637016966-3aef44701624445d9c6f17595d2af411.jpg)

What Are Fibonacci Retracements And Fibonacci Ratios

What is a Fibonacci extension.

. DEFINITION of Fibonacci NumbersLines Leonardo. Usually a stock will retrace at one of 3 common. Fibonacci ratios are calculated within the Fibonacci series numbers.

It can also be identified on a technical basis by seeing. The most popular Fibonacci. To calculate Fibonacci retracement levels use the calculations tables on the left side below.

Fill the highest and. The Fibonacci retracement levels are correlated with a percentage. After a stock makes a move to the upside A it can then retrace a part of that move B before moving on again in the desired direction C.

A Fibonacci retracement is a term used in technical analysis that refers to areas of support price stops going lower or resistance price stops. Fibonacci retracements are ratios used to identify potential reversal levels. Fibonacci calculator for generating daily retracement values - a powerful tool for predicting approximate price targets.

They trade everything from commodities like soybean and corn. Calculate Fib Levels For Any Trading Instrument. Taking advantage of the Fibonacci calculator is a great way to quickly and routinely maximise the utility of these powerful trading tools.

It is composed of 30 US. Well we know that a retracement is a move in a stock that retraces a portion of the previous move. Uptrend Stock High Price - Stock High Price - Stock Low Price Fibonacci Ratio.

Generate the Fibonacci retracement values and improve and organize your forex trading strategy. This page features a Fibonacci calculator generating both retracement and extension values for both uptrends and downtrends. This the level at which market finds more demand.

These retracements or pullbacks are what you as. If you have a correction during up-trend you select a beginning if this uptrend as a Point. Build Your Future With a Firm that has 85 Years of Investment Experience.

We have hundreds of day traders swing traders and investors visiting our site every day to use this Fibonacci Calculator. Use a Fibonacci Calculator from CapitalXtend for technical analysis. Enter start point A end point B and press Go.

To calculate Fibonacci SupportResistance lines a technical analyst select two major reversal points. The Fibonacci levels are created by drawing horizontal trend-lines between two extreme points highest high and lowest low and then dividing the vertical distance by the key Fibonacci ratios. Fibonacci levels are widely popular in financial trading as they can help determine potential support and resistance areas as well as favorable entry and exit levels.

The most commonly used ratios for traders are 382 50 618 100 1272 and 1618. These percentages will help you to know how much of a previous price movement has retraced. 1 Support level This can be calculated by the Fibonacci retracement calculator.

Fibonacci Stock Trading Using Fibonacci Retracement For Stock Market Prediction Machine Learning Applications

Fibonacci Extensions How To Calculate Fibonacci Extensions For Stocks

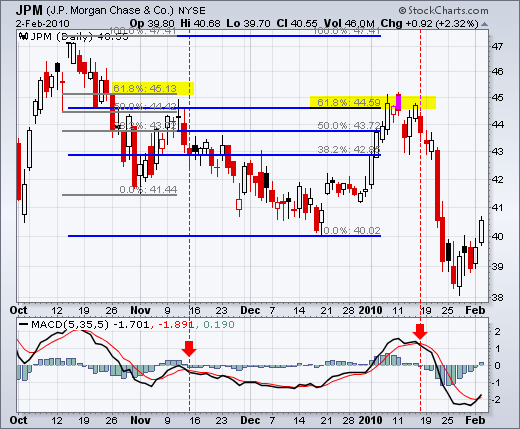

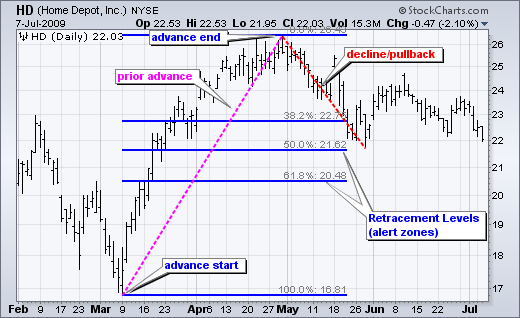

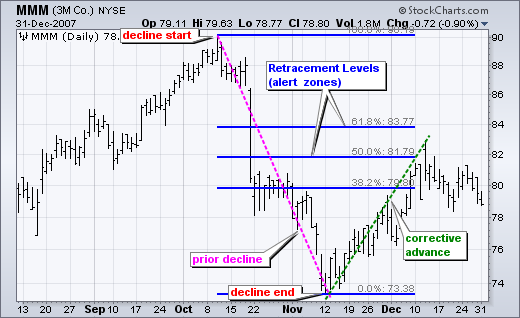

Fibonacci Retracements Chartschool

Fibonacci Retracements Chartschool

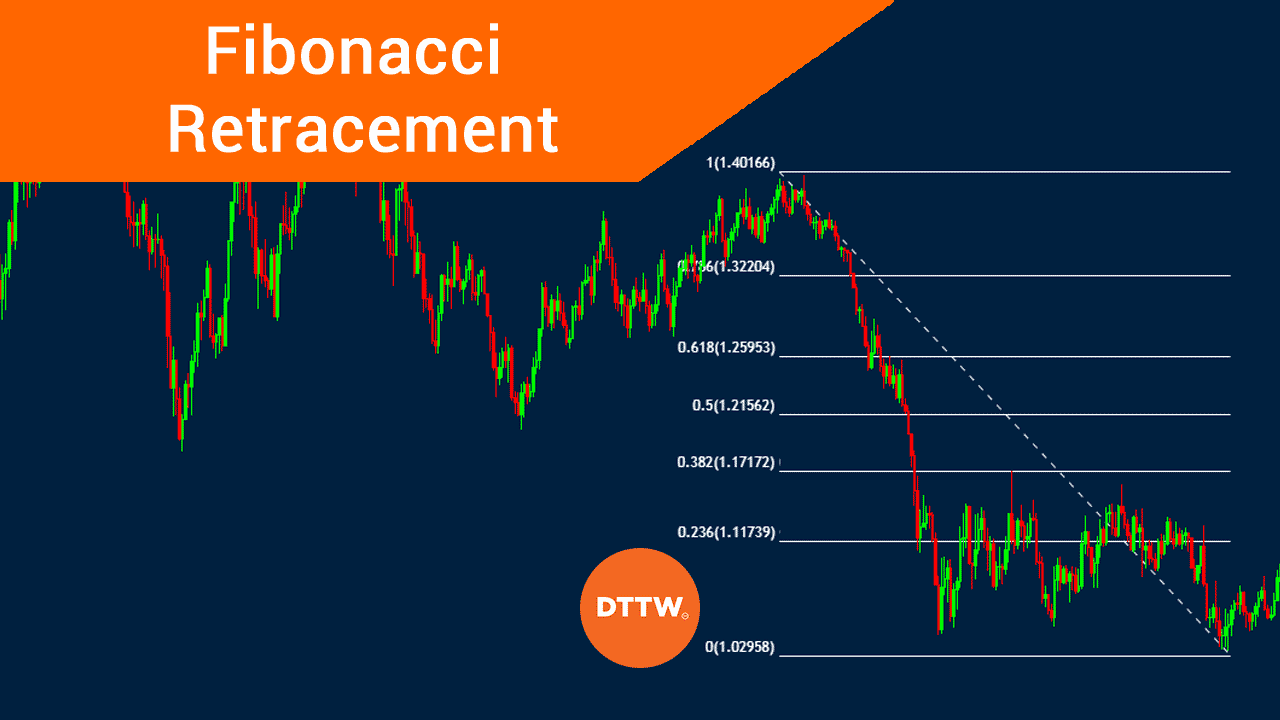

Fibonacci Retracement In Stocks Howtotrade Com

Fibonacci Retracement Levels Other 3 October 2020 Traders Blogs

Fibonacci Retracements Explained For Beginners Warrior Trading

/dotdash_Final_What_Are_Fibonacci_Retracements_and_Fibonacci_Ratios_Sep_2020-01-7b1bf4a68da246f7ace93f2ca9d64233.jpg)

What Are Fibonacci Retracements And Fibonacci Ratios

How To Use Fibonacci Retracements Babypips Com

The Fibonacci Retracement A Must Have Tool In Day Trading Dttw

Fibonacci Retracements A Guide To Using Fib Levels For Trading

Fibonacci Retracements Explained For Beginners Warrior Trading

Fibonacci Retracements Chartschool

Fibonacci Calculator Forexchurch Com

:max_bytes(150000):strip_icc()/dotdash_INV-Fibonacci-Retracement-Levels-June-2021-01-a036f12c487e47e08e14ab42e1f1823b.jpg)

Fibonacci Retracement Levels Definition

Fibonacci Retracements A Golden Ratio Idea For Tra Ticker Tape

The Fibonacci Retracements Varsity By Zerodha